Your Options in Today's San Diego, CA Real Estate Market: Buy, Sell, Rent, or Wait?

Contact George Lorimer at 619-846-1244 to receive a complimentary planning session for buying or selling a San Diego home.

When people ask, “What should I do in this market?” it’s not always a straightforward answer. Here are some real options to consider if you're thinking about selling, buying, or simply staying put.

What's My Home Worth?

If You're a Homeowner Thinking of Selling:

-

Sell Now: Capture today’s high prices and strong buyer demand before future rate or inventory changes shift the market.

-

Rent It Out: Long-term or short-term rental (Airbnb/VRBO) can generate income while you hold the asset.

-

Let Family Use It: If income isn’t the priority, allow a family member to live in the home and preserve the property for future appreciation or inheritance.

-

Trade-In Option: Programs like my “Home Trade-In” allow you to purchase your next home while we handle the sale of your current home.

If You're a Buyer Deciding Whether to Buy or Wait:

Search Homes

-

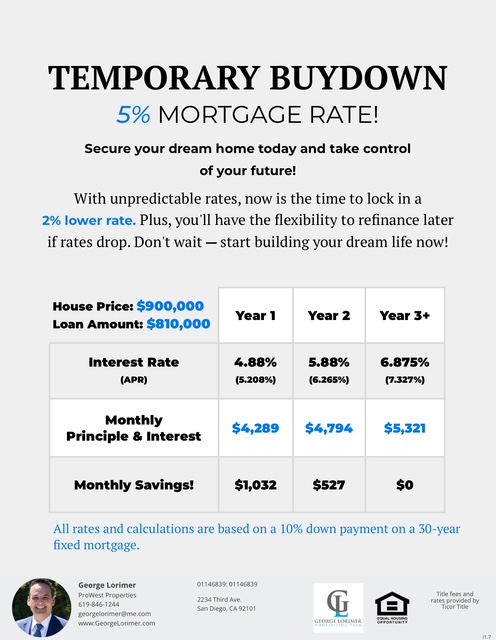

Buy Now: Lock in today’s pricing and start building equity immediately. You also benefit from property tax deductions, mortgage interest deductions, and long-term appreciation.

-

Rent: Provides flexibility and lower upfront costs, but you’re 100% exposed to future rent increases and miss out on home equity growth.

-

Relocate: Some buyers are moving to more affordable areas — either locally (Riverside, Temecula, Arizona) or out of state — to lower living costs.

The Cost of Waiting:

-

Appreciation vs Savings: Home prices in San Diego have historically appreciated 5-7% annually over the long term. Waiting 1 year could mean paying $35,000–$50,000 more for the same home.

-

Downpayment Catch-Up: As home prices rise, the larger down payment required often outpaces what buyers are able to save in that same period.

-

Tax Impact: While you save for a down payment, you may be paying more in income taxes because you're missing out on mortgage interest and property tax deductions.

-

Higher Rents: If you rent while waiting, rising rental costs may eat into your ability to save as well.